Global Ad Spend in 2015

What do recent trends in global ad spend look like, and what do they mean for the future? According to the recent Advertising Expenditure Forecasts by ZenithOptimedia, global ad spend will grow 4.9% in 2015, reaching 545 billion USD. This may sound like good news, but the figure forecasts a tough year in advertising in 2015 after the wake of the Winter Olympics and the World Cup in 2014. However, this is by no means a downward trend, as ad spending will surge in 2016 with the Summer Olympics, US Presidential elections and the European Football Championship all happening within the year.

Internet and mobile leading ad spend growth

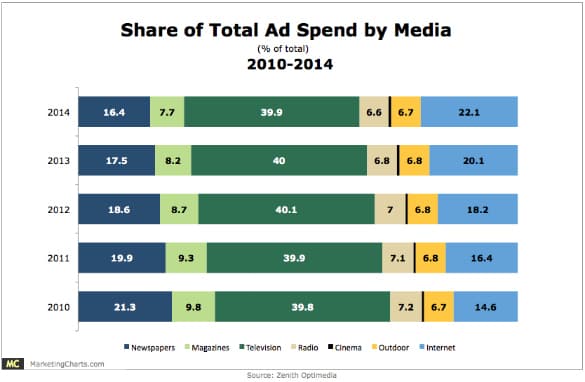

Of the 545 billion US dollars that gets put into advertising, it’s no surprise to anyone that Internet is the fastest growing medium with 16.9% growth in 2014. This growth will dip slightly in 2015 to 15% along with general ad spend.

In 2004, Internet consisted merely 4% of global advertising spending; now it’s at a whopping 24%. Mobile has become the leading driver of global ad spend growth, and research predicts that, between 2014 and 2017, it will account for more than half (51%) of all new advertising dollars. Furthermore, mobile advertising is expected to grow by an average of 38% every year in that same time period.

What is interesting to note, however, is that ad spend in mobile lags in comparison to its share of media consumption: while mobile accounts for 6.2% of all ad spend in the US in 2014, it takes up 23.3% of media consumption time. This is due to the fact that conventional display advertising does not work well on mobile. How many times did you think to click on a banner ad that showed up while you were furiously playing Candy Crush on your phone?

Facebook and Twitter take a chunk of mobile ad spend

We can look to social media like Facebook and Twitter for some guidance in mobile advertising. They worked furiously to work in digital display into their services. Their ads blend seamlessly into users’ feeds, which gives them a native feel rather than putting the user off. Between Facebook and Twitter, they are poised to take 33% of all mobile ad spend this year.